Design and concept of all tokens, components and documentation from scracth. The work started a month before the app development, in which I participated.

Team:

Files:

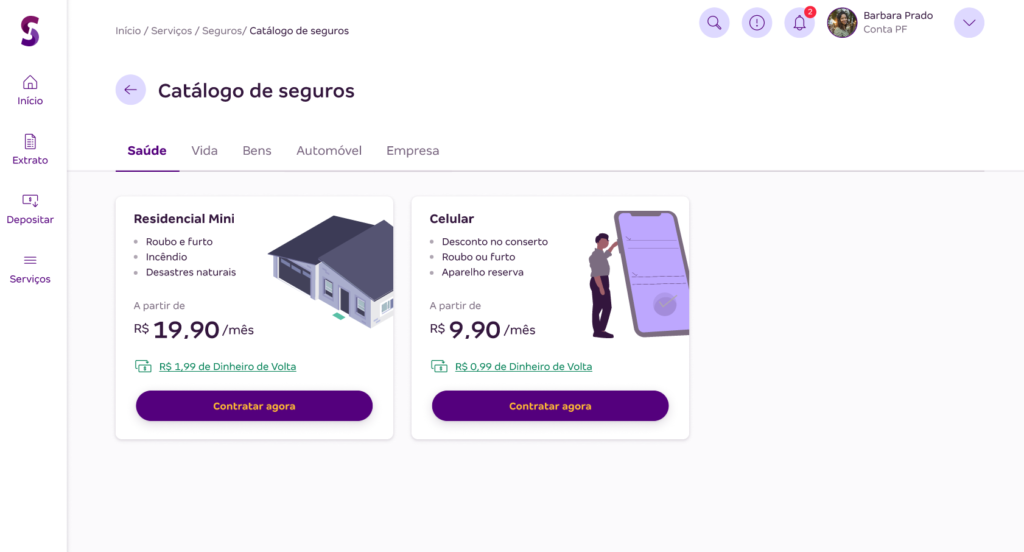

After the first month of the development of the Design System , the project was divided into 4 squads: Credit, Payment Methods, Companies, and Insurance and Investiments, the squad I was in.

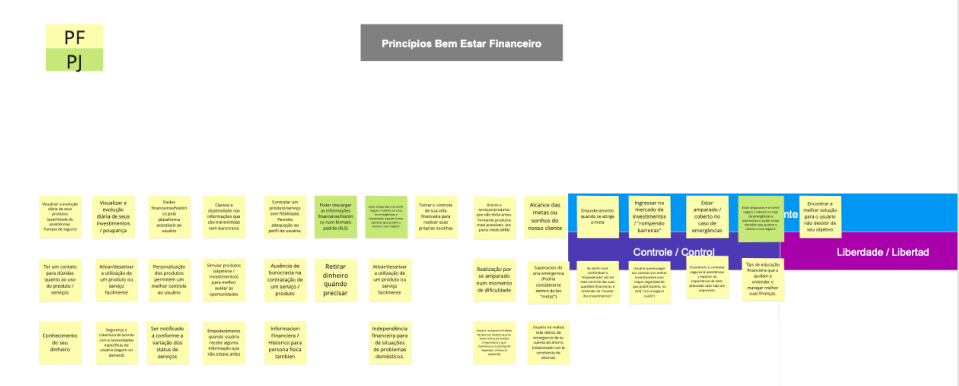

The goal was to integrate all project stakeholders, sharing Superuinon researche’s results and creating product strategy to guide the team during the 6 months of the project. There was 4 design sprints happening at the same time, one for each squad, for them to build a roadmap for the MVP.

We obtained data through desk researches and enterviews with specialists. It was brough that the fintech market was very competitive, with high technology and plenty of product offers.

According to the research:

The research results were discussed and shared in order to elect the most significant insights and path to build the product

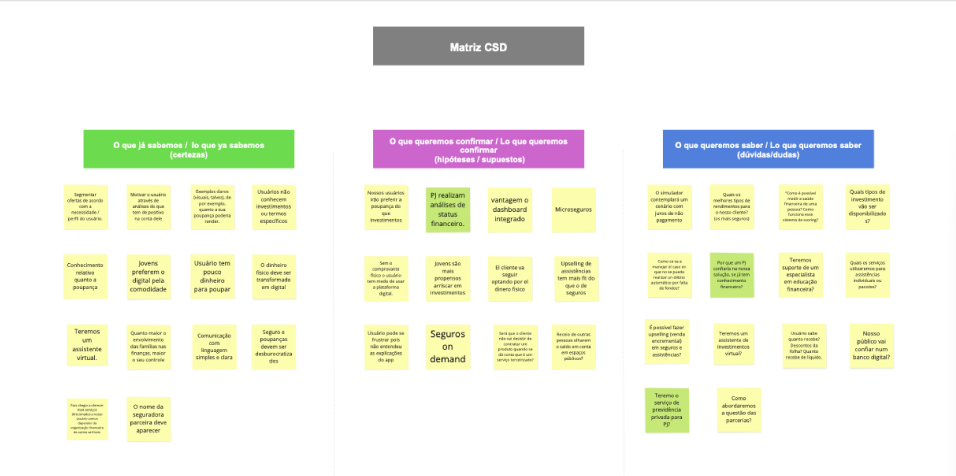

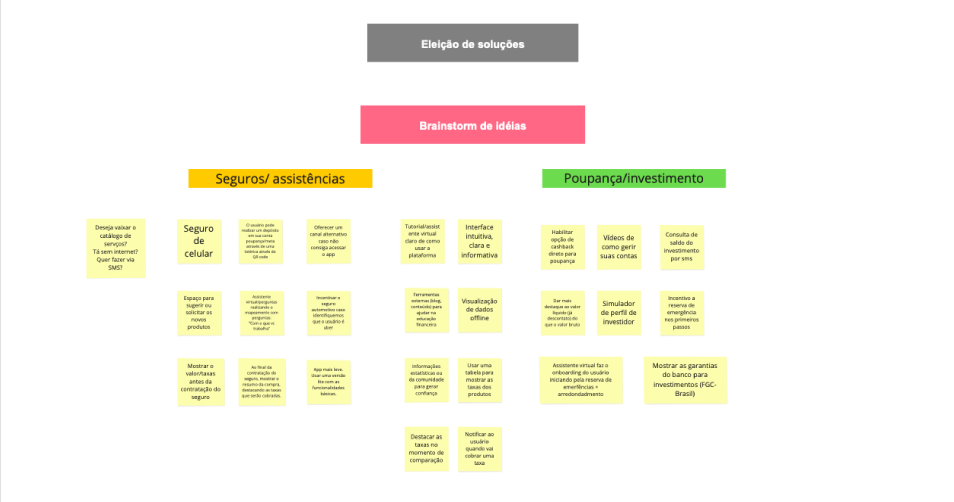

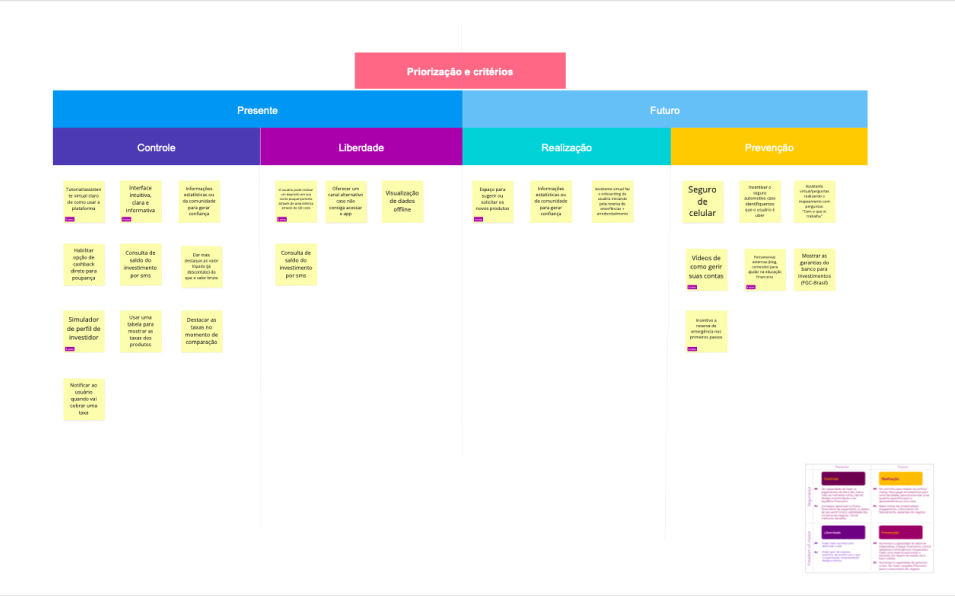

Activities: Superunion insights presentation / Product principles / CSD Matrix (Certainties, Guesses and Doubts) / Inicial Journey / Solution brainstorming / Features mind mapping / Priorization Matrix

The goal was understanding what the players offered and investiganting relevant and features, focusing on product and usability

The evaluation consisted on:

The criterias were:

Players

The analysis considered:

General aspects

Strong points

Waek points

Opportunities

Unfortunately this material was lost due to a problem with Miro.

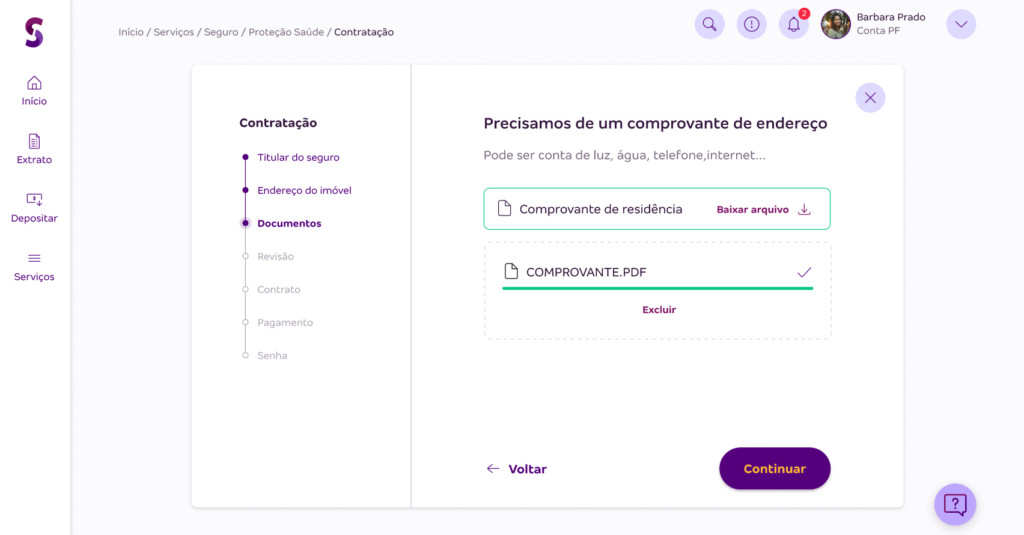

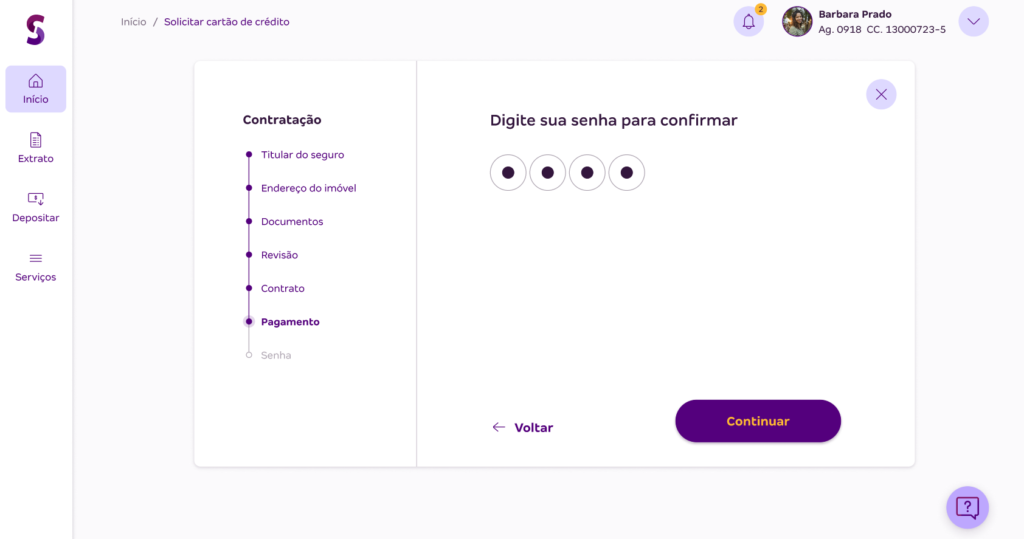

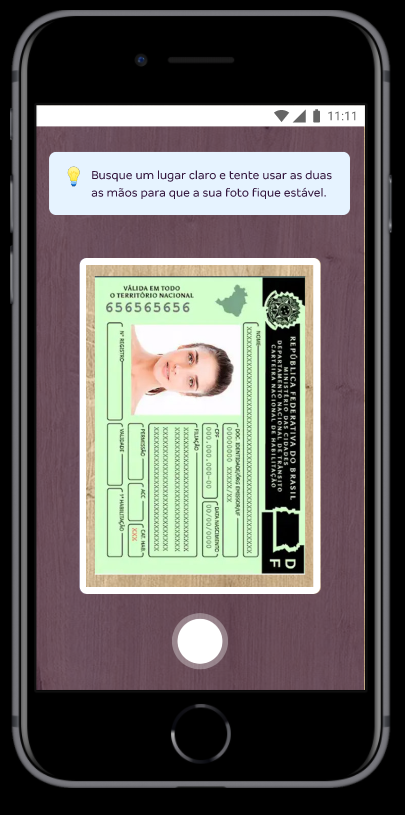

Before prototyping, we worked on the squad information architecture, wireframe designing, sitemaps, mindmaps and interaction flows.

We tested all hiring flows, evaluating the experience of the mobile prototype in clarity, information hierarchy and user understanding.

User recruitment requeirements:

We had moderate and non-moderate usability tests through Useberry.

Moderate script:

Non-moderated script: